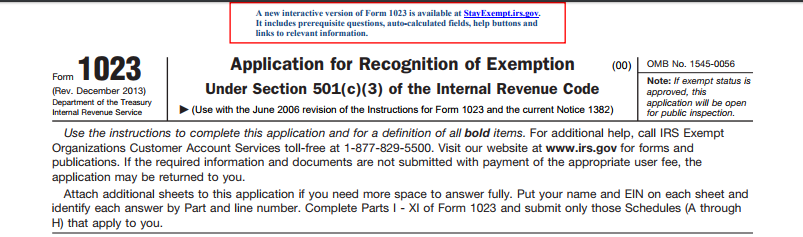

Application for tax-exempt status

Organizations that are operating as nonprofits are not automatically tax-exempt. To qualify as exempt from federal income tax, a nonprofit organization must meet the requirements and apply with the IRS to obtain tax-exempt status.

The IRS Suggest Understanding the Following before Applying for Tax Exempt Status:

- State law governs nonprofit status, which is determined by an organization’s articles of incorporation or trust documents. Federal law governs tax-exempt status. The Internal Revenue Code specifically refers to exemption from federal income tax.

- Each application for exemption must be accompanied by an exact copy of the organization’s organizing document: Articles of incorporation for a corporation, articles of organization for a limited liability company, articles of association or constitution for an association, or trust agreement or declaration of trust for a trust. If the organization does not have an organizing document, it will not qualify for exempt status.

- State law generally determines whether an organization is properly created and establishes the requirements for organizing documents

The application process can be difficult and confusing for the Nonprofit Organization.

We’ll help you define the Organization’s mission and explain your charitable purpose so the IRS can see how all the many requirements are met. We’ll then assists with the preparation of all the necessary paperwork and promptly file your Form 1023 with the IRS.